Planning for Family Wealth Transfer

We seem to be hearing less about the coming transfer of wealth from the senior generation to the next generation, I think the baby boomers got tired of talking about it. That doesn’t mean it’s not going to happen and smart money (that is long term, generational money) stewards are still contemplating how this transfer will happen.

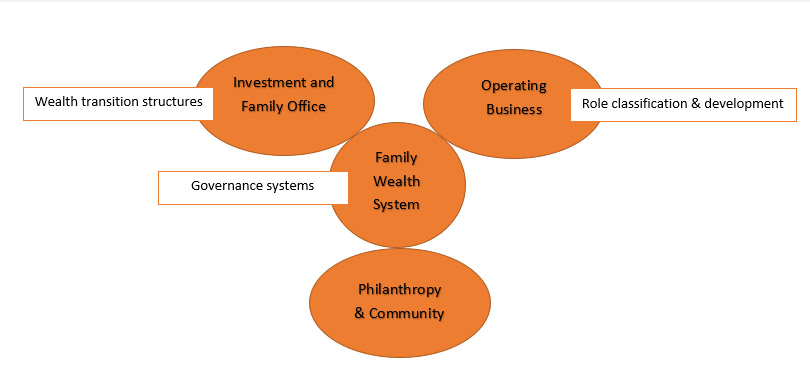

I will leave income tax implications to the tax experts and the legal considerations to the legal fraternity. As a coach to families in business I will focus on the three components of wealth transfer that all families in business, which includes businesses that have moved from operating businesses to investment and “family bank” businesses, should be considering.

Role classification and development

Governance systems

Wealth transition structures

Family wealth transfer is a process, it takes time and planning.

The questions that need to be asked (and answered) are:

- What kind of wealth is being transferred; Is it shares in the family business?

- Real estate? Investment capital?

- From whom and to whom will it be transferred?

- Is there a legacy consideration to a favorite charity?

- Will the wealth be going to an adult or to minor children/grandchildren? Should some type of trust be involved?

- How will each transition occur? Will there be gifts, a sale or both?

- What conditions will be imposed as a result of the transition?

- How will the wealth be shared among recipients, (if it is shared)? Will it be in one move or over a period of time?

The goal of any family wealth transfer plan is to build and retain healthy family relationships, develop a culture of responsible wealth stewardship and advance the family legacy.

The family wealth system comprises of three types of capital. The most obvious is the financial capital but equally important are the human capital, defining who is in the family and social capital – the family’s responsibility to the community. Different family members will take different roles in developing and recognizing these capitals, depending on their personal interest and acumen.

This is what we call a family wealth map, you can add parts to it such as; related family members (outside the nuclear family), community relationships, vendors or customer and competitors. The point is to develop a pictorial story to help develop the family wealth system and transfer plan in an inclusive manner.

One key consideration in the age of change; the long-term family wealth system must be adaptive, this is usually established in the development of the governance system.

At Copper Beech Company, we believe that planning for the future helps create the future you want. We help clients identify goals and we care about the results our clients achieve. Whether the goals are improving financial position, growing the business, transitioning management and ownership. Helping Clarify goals, plan the route and holding the client accountable for achieving the milestones along the way is how we bring value to the engagement.

At Copper Beech Company, we believe that planning for the future helps create the future you want. We help clients identify goals and we care about the results our clients achieve. Whether the goals are improving financial position, growing the business, transitioning management and ownership. Helping Clarify goals, plan the route and holding the client accountable for achieving the milestones along the way is how we bring value to the engagement.